UK targets tech giants with new digital tax in Budget

Chancellor says move will raise £400m from firms like Facebook

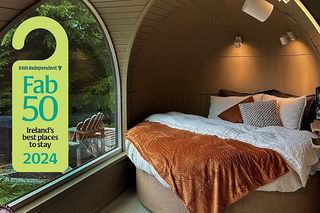

Box office: UK chancellor Philip Hammond shows off the traditional red box ahead of his Budget speech. Photo: Getty Images

The UK is targeting the likes of Google and Facebook by introducing a digital services tax that aims to raise £400m (€450m) a year for the government.

Chancellor of the Exchequer Philip Hammond unveiled the measure in his Autumn Budget in London yesterday.

He said it was designed to hit the largest internet businesses - not consumer or internet startups.

It would affect companies that were profitable and with annual revenues of at least £500m, he said.

"We will consult on the detail to make sure we get it right, and to ensure that the UK continues to be the best place to start and scale-up a tech business," he said. "It will come into effect in April 2020."

The tax follows the Chancellor of the Exchequer's comments during a speech at the Conservative Party conference on October 1 that the UK would "go it alone" if an EU version of the tax continued to stall.

Controversially, the UK tax targets revenue linked to UK users, not profits, according to tax practitioners, potentially making the country a less attractive place for large tech firms to supply their services.

The EU version of the tax, which would require the unanimous support of the bloc to be passed, is being opposed by a number of countries, including Ireland.

Ireland has said that it has concerns about taxing revenue rather than profits, and that the best place for reforming the way multinationals pay tax is via the Organisation for Economic Co-operation and Development (OECD).

Mr Hammond's bold move will probably put more pressure on Ireland and other countries which are against the EU plan.

Last week, French Finance Minister Bruno Le Maire claimed EU countries were "very close to an agreement" on implementing the deal.

"There's a vast movement to progress in this direction, but as always in Europe the most difficult is the decision... we can achieve unanimity."

He said concerns about double taxation - being taxed twice for the same activity - that had been raised by Ireland, Sweden, and Finland - were a "smokescreen".

Startups will not be in line for the tax, Mr Hammond emphasised yesterday.

In his Budget speech he said it would be aimed at "search engines, social media platforms and online marketplaces".

Russ Shaw, founder of Tech London Advocates, an industry body, said the digital services tax was "a prudent step" but "the wrong approach".

"Tackling the digital tax question without coordinating efforts with the US and EU as key global partners will only further entrench Britain in an isolationist position we cannot afford," he said.

Mr Hammond said yesterday that the tax will be a temporary measure until an international framework for corporate tax reform is agreed.

Join the Irish Independent WhatsApp channel

Stay up to date with all the latest news